2024 City budget balances critical investments with affordability

HAMILTON, ON – Today, City Council reduced and approved the City's 2024 budget, continuing its proven track record of responsible fiscal leadership. Hamilton’s 2024 budget recognizes the challenges residents are facing while making critical investments toward growth-enabling infrastructure, delivering high-quality services and programs, and tackling issues related to housing and homelessness.

In keeping with Mayor Horwath’s budget direction, throughout the budget development process, Council and City staff looked for opportunities to reduce the burden on taxpayers by responsibly using reserves (savings), reviewing budgets for efficiencies, and prioritizing spending against Council Strategic Priorities.

“I’m grateful to Council and staff who worked hard on this year’s difficult budget,” said Mayor Andrea Horwath. “Despite challenges related to provincial downloading, economic pressures and rising costs, Council was able to lower the City’s portion of the budget to 3.24% with an overall tax impact of 5.79%. Council was willing to have tough conversations and make difficult decisions, working with staff to address affordability for Hamiltonians while ensuring we invest in critical City programs and services. The 2024 budget manages the costs downloaded by the province, delivers responsible and sustainable enhancements, and maintains service excellence.”

The Budget demonstrates the City’s commitment to sustainable economic and ecological development, safe and thriving neighbourhoods, and responsiveness and transparency. The following are some of the projects included in the 2024 Budget that highlight the City’s dedication to community well-being:

- Responding to the housing and homelessness crises with increased funding to support the construction of new affordable housing and shelter spaces and to develop a Winter Response Strategy and Food Strategy to support local food banks.

- Providing additional funding to protect tenants and sustain Housing Providers.

- Maintaining City assets and the services that matter most to residents while making crucial improvements to important programs like litter management.

- Enhancing levels of funding for public safety services, ensuring that Fire, EMS, and Police departments have the resources necessary to protect and serve our community in a timely and effective manner.

- Making it easier to get around the city by investing in the transportation network, including roads, bridges, sidewalks, multi-use paths, and traffic management.

- Increasing and improving transit service frequency by adding an additional 49,000 hours of service.

- Preparing responsibly for climate change by investing in the City’s new Climate Change Reserve and various other initiatives such as greening the City’s Fleet, developing an urban forestry strategy, and planting trees.

- Enriching the quality of life for residents by investing in parks, recreation, and cultural assets.

- Improving customer service and digital technology and modernizing systems to better serve our diverse community.

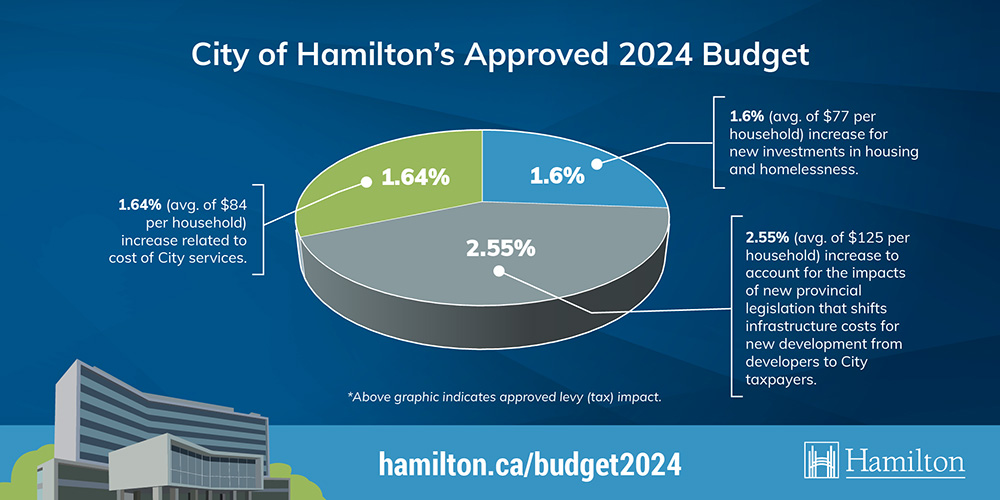

Overall, the 2024 Budget represents an average property tax increase of 5.79% as follows:

- 1.64% (avg. of $84 per household) increase related to the cost of City services.

- 1.60% (avg. of $77 per household) increase for new investments in housing and homelessness.

- 2.55% (avg. of $125 per household) increase to account for the impacts of new provincial legislation that shifts infrastructure costs for new development from developers to City taxpayers.

“The City’s 2024 budget maximizes investment in the core infrastructure our community relies on while at the same time providing critical supports for people in our community who need them,” stated Councillor John-Paul Danko, General Issues Committee Budget Chair. “This is no easy task given the challenges municipalities face and the impact of downloading from other levels of government, but Council worked diligently to decrease tax increases, striking a balance between investing in key areas and reducing the tax burden.”

The City of Hamilton remains committed to providing high quality services and programs in a financially responsible and sustainable way.

For detailed information about budget investments, visit www.hamilton.ca/2024-tax-rate-budget.

- 1.64%: (average of $84 per household) increase related to cost of City services

- 1.6%: (average of $77 per household) increase for new investments in housing and homelessness

- 2.55%: (average of $125 per household) increase to account for the impacts of new provincial legislation that shifts infrastructure costs for new development from developers to City taxpayers.

- Above graphic indicates approved levy (tax) impact