2023 Tax & Rate Budget

Public Delegations

- November 21, 2022

Rate Supported Budget

- November 24, 2022

Targeted Budget Approval (Council Meeting)

- November 25, 2022

Tax Supported Capital Budget Overview

- January 10, 2023

Boards & Agencies Presentations

- January 11, 2023

- January 19, 2023

Departmental Presentations

- January 23, 2023

- January 24, 2023

- January 26, 2023

- February 3, 2023

Targeted Tax Budget Approval (Special Council Meeting)

- March 29, 2023

Since 2018, the City of Hamilton has adopted a multi-year budget to better reflect the future forecast. In 2023, the City’s budget plans considered the following challenges:

- Inflation – Current inflation, supply chain impacts and labour shortages in Ontario that continue to pose significant challenges for municipalities. Some of the challenges the City of Hamilton has faced include our ability to purchase items essential to operations such as fuel, chemicals, asphalt and contracted services, as well as our labour. For example, the cost of fuel has risen $0.50/L or 45% over the past year.

- Rising interest rates – The Bank of Canada continues its efforts to address inflation through expected higher interest rates. Like individual citizens, this impacts City costs, including a higher borrowing rate, affecting the City’s ability to finance capital infrastructure. For example, the Bank of Canada overnight interest rate has seen a 3.5% increase so far in 2022, from 0.25% to 3.75%.

- COVID-19 response & recovery – No formal announcements at this time from higher levels of government for additional financial support that would help municipalities address the ongoing response and recovery efforts related to the COVID-19 pandemic beyond 2022. For example, the $200 million investment from senior levels of government for pandemic related relief funding will have been exhausted in 2022, leaving the City to incur these costs.

- Future commitments – Funding that has already been allotted to support commitments in the coming years. For example, in the fall of 2022, City Council approved $35 million to directly support housing.

In 2023, property taxes will increase by 5.8% over 2022 levels, with 2.5% of that tax increase due to increased costs of running existing services. The remainder of the increase goes towards service enhancements, including housing and housing-related supports, transportation and mobility, and health and safety.

All City Council decisions around budget are informed by budget presentations, staff recommendations, and public delegations and feedback.

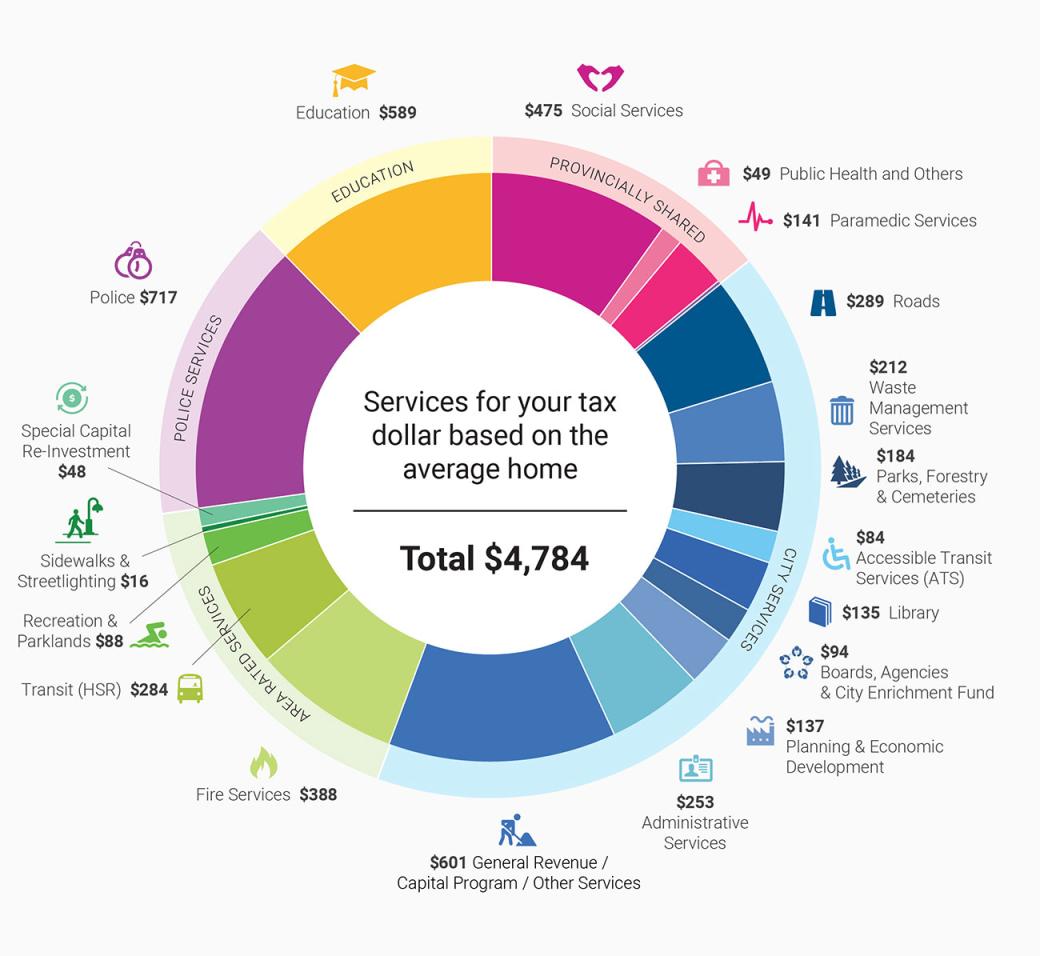

2023 Distribution of Tax Dollars

| Provincial Impact & Legislated Programs | $ Amount |

|---|---|

| Social Services | 475 |

| Public Health & Others | 49 |

| Paramedic Services | 141 |

| City Services | $ Amount |

| Roads Programs | 289 |

| Waste Management Services | 212 |

| Parks, Forestry, Cemeteries | 184 |

| Accessible Transportation Services (ATS) | 84 |

| Library | 135 |

| Other Boards & Agencies / City Enrichment Fund | 94 |

| Planning/Economic Development | 137 |

| Administrative Services | 253 |

| General Revenue/Capital Program/Other Services | 601 |

| Area Rated Services | $ Amount |

| Fire Services | 388 |

| Transit (HSR) | 284 |

| Recreation & Parklands | 88 |

| Sidewalk & Streetlighting | 16 |

| Special Capital Re-Investment | 48 |

| Police Services | $ Amount |

| Police | 717 |

| Education | $ Amount |

| Education | 589 |