2024 Tax & Rate Budget

Public Delegations

- November 6, 2023

Rate Supported Budget

- November 21, 2023

- November 27, 2023 (if required)

Targeted Budget Approval (Council Meeting)

- December 13, 2023

Public Delegations

- January 16, 2024

Tax Supported Capital Budget Overview

- January 19, 2024

Boards & Agencies Presentations

- January 22, 2024

Housing & Departmental Presentations

- January 23, 2024

- January 25, 2024

- January 26, 2024

Budget Deliberations

- January 30, 2024

Targeted Tax Budget Approval (Special Council Meeting)

- February 15, 2024

The City of Hamilton’s 2024 Approved Tax Operating and Capital Budget

The City of Hamilton is committed to providing quality programs and services in a financially responsible and sustainable way. Hamilton’s 2024 budget recognizes the challenges residents are facing while making critical investments toward growth-enabling infrastructure, delivering high-quality services and programs, and tackling issues related to housing and homelessness.

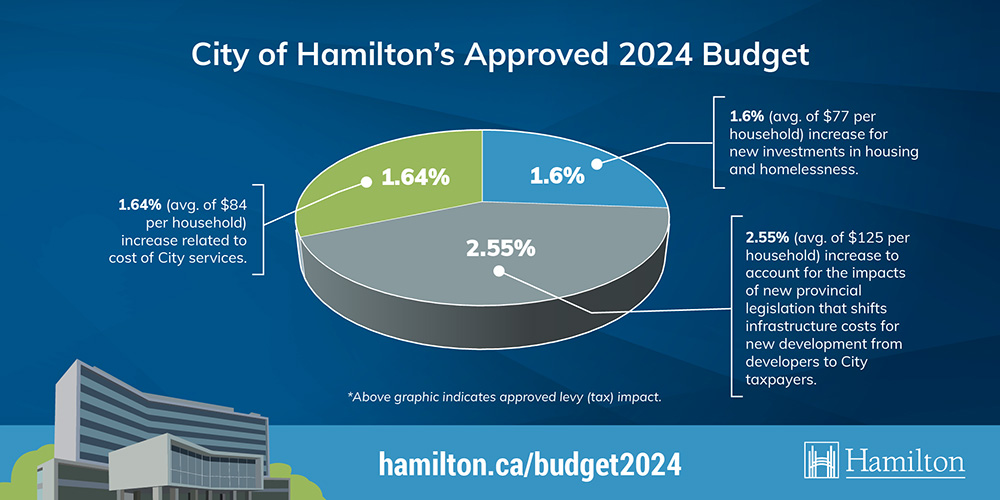

Overall, the 2024 Budget represents an average residential property tax increase of 5.79% as follows:

- 1.64% (avg. of $84 per household) increase related to the cost of City services.

- 1.60% (avg. of $77 per household) increase for new investments in housing and homelessness.

- 2.55% (avg. of $125 per household) increase to account for the impacts of new provincial legislation that shifts infrastructure costs for new development from developers to City taxpayers.

City of Hamilton's 2024 Budget & Financing Plan

In September, City Council was presented with a Budget Outlook that predicted a 14.2% property tax increase, including the costs of covering provincially mandated impacts. The final approved 2024 Budget was created following Mayor Horwath’s direction to City staff to present a combined operating and capital budget that reduced the burden on taxpayers by responsibly utilizing strategic reserves, screened budget submissions for redundancies and efficiencies, and prioritized new spending against its ability to advance council identified priorities.

Budget Process Timeline

- January 19, 2024 General Issues Committee Budget Overview - presentations from an external economist and staff on the City of Hamilton's Economic Outlook and Budget Overview

- January 22 to January 26, 2024 – General Issues Committee presentations from City Departments and from Boards and Agencies

- January 30, 2024 – General Issues Committee Budget Deliberations

- February 15, 2024 – Special Council Meeting to consider final budget approval

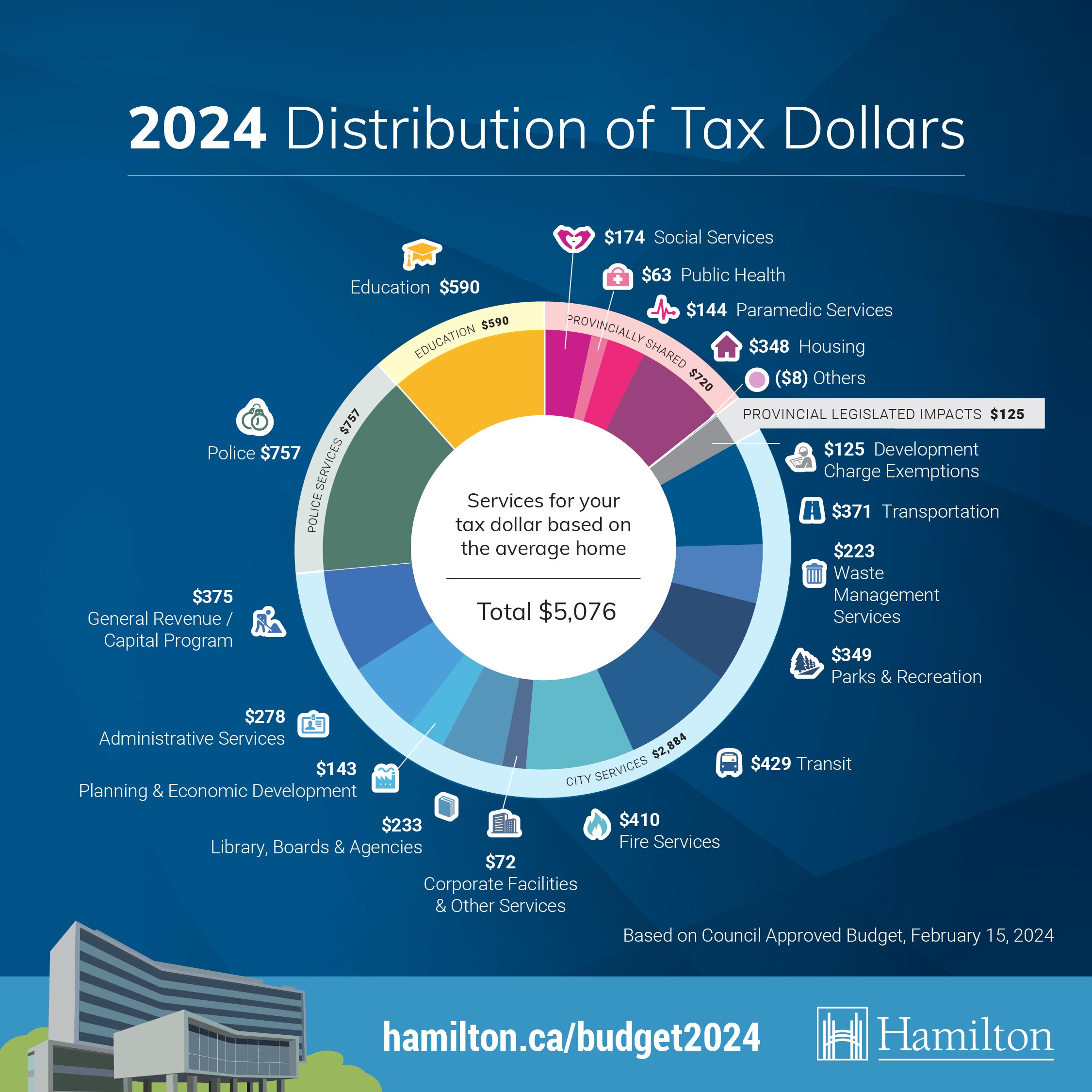

| Provincial Impact & Legislated Programs | Amount |

|---|---|

| Social Services | $174 |

| Public Health | $63 |

| Paramedic Services | $144 |

| Provincial Legislated Impacts | Amount |

| Development Charge Exemptions | $125 |

| Housing | $348 |

| Others | $8 |

| City Services | Amount |

| Transportation | $371 |

| Waste Management Services | $223 |

| Parks & Recreation | $349 |

| Transit | $429 |

| Fire | $410 |

| Corporate Facilities & Other Services | $72 |

| Library, Boards & Agencies | $233 |

| Planning/Economic Development | $143 |

| Administrative Services | $278 |

| General Revenue/Capital Program/Other Services | $375 |

| Police Services | Amount |

| Police | $757 |

| Education | Amount |

| Education | $590 |

Frequently Asked Questions

The 2024 total approved budget is $2.4 billion. This money helps the City of Hamilton deliver quality programs and services while also being financially responsible and planning for the future. The budget funds more than seventy (70) City programs and services, external boards and agencies, and needed community initiatives.

The 2024 budget includes a 5.79% property tax increase, including:

- 1.64% to cover City services (will cost an average of $84 per household),

- 1.6% for new investments in housing and homelessness (will cost an average of $77 per household), and

- 2.55% to help manage the impacts of new provincial legislation that shifts infrastructure costs for new development from developers to City taxpayers and ratepayers (will cost an average of $125 per household).

The average household (based on an assessment value of $385,900) will pay an increase of around $23.83 a month, totalling $286 per year.

The City relies on property taxes to deliver a variety of services including, transit, parks, recreation, cultural assets, and economic development to ensure a safe and vibrant community. Hamilton, like other cities across Ontario, is facing budget challenges because of rising interest rates, inflationary costs, the increasing cost of materials, labour, and utilities – those impact the City just as they’re impacting your family or business. The city's growth, Council’s priorities, and the impact of downloading from other levels of government are also factors in determining the budget.

Mayor Horwath directed staff to present a budget that reduced the burden on taxpayers by responsibly using reserves (savings), reviewing budgets for efficiencies, and prioritizing spending against Council’s strategic priorities. The City also continues to advocate to other levels of government for increased contributions toward City/Province shared-cost programs, such as Housing, Long-term Care, Ontario Works, Public Health, and Paramedic Services.

The 2024 budget focuses on balancing affordability with the need to make critical investments in the services and programs citizens rely on most. Spending supports Council’s three priorities – sustainable and ecological development, safe and thriving neighbourhoods, and responsiveness and transparency from the City. The budget invests in maintaining high-quality City programs and services, supporting infrastructure as well as housing and homelessness. The budget seeks to create value for our residents, meet the diverse needs of Hamiltonians, and delivers fiscally responsible enhancements while managing the costs downloaded by the province.

Yes. The 2024 budget makes key investments in the core services and infrastructure our community relies on to deliver value to our residents. There have been enhancements to services and programs in many areas including funding to improve the availability of affordable housing in the city and for local housing providers, funding for the City’s Winter Response Strategy to support our most vulnerable residents, as well as the family shelter system and other tenant supports.

The budget will also support park upgrades, spray pads, and improved sport lighting, fund enhancements to managing litter in the city, and see the City further increase its fleet of green City vehicles. The City will also be able to make improvements to bridges, sidewalks and roads, continue its Vision Zero campaign for road safety and support the City’s Cycling Master Plan.

It will also fund an additional 49,000 hours of transit service and 33 buses to enhance the service and replace some end-of-life buses.

The budget will also enhance funding for public safety services, ensuring that Fire and EMS have the staffing and training necessary to protect and serve our community in a timely and effective manner as well as the equipment needed to keep pace with the growing demand for services.

Through the 2024 budget process, the City had to navigate a challenging financial situation with provincial downloading and rising costs and interest rates, while still making sure it maintained the services and programs Hamiltonians rely on and invested in key areas such as housing and homelessness. The City relies on property taxes as the major source of revenue.

We know these are difficult times for everyone with increased living and housing costs. The City will continue to monitor its financial situation to ensure it can continue to support community needs well into the future, while balancing investment with citizen affordability. The City will also continue to advocate to other levels of government for more funding support, lessening the reliance on local taxpayers.

The City has made significant investments to support vulnerable Hamiltonians at different stages of housing. Key housing investment highlights include funding the City’s Housing Sustainability Investment Roadmap (HSIR) – the City’s plan for addressing the current housing crisis – housing with support for women, transgender, and non-binary persons, enhanced winter response for individuals who are homeless, support for the family shelter system, funding for tenant support to help people stay in their homes, support for local food banks and grant funding for community groups through the Community Enrichment Fund.

As part of its 2024 tax budget, the City of Hamilton is investing $158 million to increase affordable housing and reduce homelessness, and $72.3 million from its reserves to support the City’s Housing Sustainability and Investment Roadmap (HSIR) over the next three years.

Provincial and Federal funding to cities increased during the COVID-19 pandemic to support the needs of unsheltered people. The Federal and Provincial governments ended the additional financial support for transit, hotel overflow, and other supports at the end of 2021. The costs to support unsheltered people still exist because of various factors and are now funded mainly by the City.

In 2024, the new municipal funding for cycling investment is $2.3 million. The City’s Accelerated Active Transportation Plan includes projects and associated funds for both stand-alone cycling projects and projects where the cycling components are being integrated with other road and transportation projects.

The City is making investments in maintaining and improving its assets and infrastructure, and the transportation network. This includes bridges, sidewalks, roads, traffic control measures and parks. The City is continuing to advance its Vision Zero road safety program, and expanding transit and cycling in the city. Some key investments and projects include replacing 33 buses, improved transit maintenance and storage facilities, park pathway resurfacing, spray pads, sport lighting, cemetery improvements and tree planting.

Yes. The 2024 budget makes investments in parks, recreation, and cultural programs and supports the maintenance and enhancements of public spaces, recreational and cultural facilities that enrich the quality of life for residents. Some examples include investments in park pathway resurfacing, sports lighting, spray pads, and museum repairs and restoration projects. The multi-year budget also supports investments in the implementation of the Parks and Recreation Master Plan to purchase land to open parks and create more green space. These investments allow the City to keep pace with growth and create vibrant spaces for Hamiltonians.

Yes. The City is investing $2 million in a capital fund to support economic development initiatives, support small business and attract investments to the city. Additionally, the City is providing investment in funding to support grants, loans and other programs directed at small businesses and business improvement areas.

Yes. Council has set aside $2.5 million in the City’s new Climate Change Reserve to support programs and initiatives that advance the City’s climate action strategy, such as the greening of the City’s fleet, increasing parkland, enhancing multi-modal systems, including bike lanes and pedestrian pathways, further investments in greening City facilities, and supporting the planting of 20,000 trees through the City’s Urban Forest Strategy.

To ensure transparency and accountability, the budgeting process involves staff reports and presentations, public meetings, opportunities for resident engagement and feedback, and extensive financial reporting. These measures help to promote trust and confidence in the way the City manages its finances.